| |

|

Amazon buys big stake in Future Coupons

|

|

Indian retail segment is set for a clash between US-major Amazon and Mukesh Ambani's Reliance Retail with the former acquiring 49 pc stake in Kishore Biyani's Future Coupons Ltd. The deal allows Amazon to acquire all or part of Biyani's shareholding in Future Retail Limited three years from now.“Amazon has agreed to make an equity investment in Future Coupons Limited for acquiring a 49 pc stake comprising both, voting and non-voting shares,” Future Retail said in a statement to the stock exchanges. As part of the agreement, Amazon has been granted a call option. This call option allows Amazon to acquire all or part of the Promoters' shareholding in Future Retail Limited (Company), and is exercisable between the third to tenth years, in certain circumstances, subject to applicable law. Indian retail segment is set for a clash between US-major Amazon and Mukesh Ambani's Reliance Retail with the former acquiring 49 pc stake in Kishore Biyani's Future Coupons Ltd. The deal allows Amazon to acquire all or part of Biyani's shareholding in Future Retail Limited three years from now.“Amazon has agreed to make an equity investment in Future Coupons Limited for acquiring a 49 pc stake comprising both, voting and non-voting shares,” Future Retail said in a statement to the stock exchanges. As part of the agreement, Amazon has been granted a call option. This call option allows Amazon to acquire all or part of the Promoters' shareholding in Future Retail Limited (Company), and is exercisable between the third to tenth years, in certain circumstances, subject to applicable law.

“The Promoters have also agreed to certain share transfer restrictions on their shares in the company for the same tenure, including restrictions to not transfer shares to specified persons, a right of the first offer in favour of Amazon, all of which are subject to mutually agreed exceptions (such as liquidity allowances and affiliate transfers),” Future Retail said. The deal comes in the backdrop of Mukesh Ambani-backed Reliance Retail getting ready to roll out its New Commerce platform with the aim to become one of the top 20 retailers globally. “Our beta trials with thousands of merchants across multiple locations in the country established the premise of New Commerce with a significant increase in sales and improvement in margins for the participating merchants. We are now getting ready to roll out the platform at a larger scale,” Mukesh Ambani, chairman of RIL, had said at the recent AGM of the company. Amazon is increasing its investments into India. While it has already cornered a significant market share in the online retail space, the acquisition of Future Retail stake is an indication that the American company is gearing up for full-fledged retail battle.

|

|

Enterprise digital security spending rises

|

|

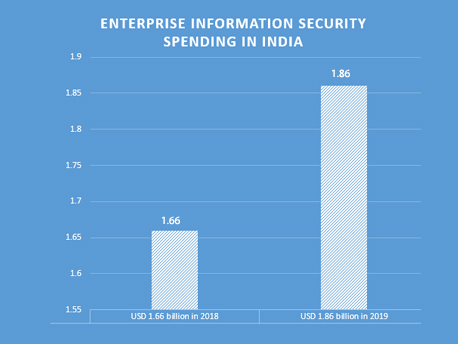

In view of rising threats posed by cyber crime in India, companies are taking steps to protect themselves. Enterprise information security spending in India is set to grow to USD1.86 billion in 2019, a 12.4 pc rise from 2018, according to a forecast by Gartner.“The increased awareness on the benefits of risk assessment and the acknowledgement that security is one of the enablers of digital transformation are boosting enterprise security spending in India. In addition, the rise in advanced cyber-attacks, ransomware and malware attacks has made cybersecurity a top investment priority for Indian Chief Information Security Officers (CISOs), therefore, increasing spending on security locally,” Prateek Bhajanka, principal research analyst at Gartner, said. In view of rising threats posed by cyber crime in India, companies are taking steps to protect themselves. Enterprise information security spending in India is set to grow to USD1.86 billion in 2019, a 12.4 pc rise from 2018, according to a forecast by Gartner.“The increased awareness on the benefits of risk assessment and the acknowledgement that security is one of the enablers of digital transformation are boosting enterprise security spending in India. In addition, the rise in advanced cyber-attacks, ransomware and malware attacks has made cybersecurity a top investment priority for Indian Chief Information Security Officers (CISOs), therefore, increasing spending on security locally,” Prateek Bhajanka, principal research analyst at Gartner, said.

“The growth of enterprise spending on information security in India will continue to grow to reach over USD2 billion in 2020,” said Prateek Bhajanka, principal research analyst at Gartner. Security services will attract the most spending from CISOs and security leaders in 2019 as local organisations emphasise on threat detection, compliance and security hygiene. In 2019, security services will represent 51.5 pc of the total enterprise information security spending in India.

With rising use of cloud by enterprises, it is little wonder then that their spending on cloud security is expected to total USD 4 million in 2019, an increase of 300 pc from 2018.“The Personal Data Protection bill, which is likely to be accepted by the Indian parliament in 2019, and the government’s initiatives like ‘Digital India’ and ‘Smart City’ are increasing net-new adopters of cloud,” said Rustam Malik, principal research analyst at Gartner. “In addition, Indian organisations are increasingly using cloud-specific security tools such as Cloud Access Security Broker (CASB) solutions for threat prevention, data loss prevention and compliance requirements, which is fuelling the triple-digit growth of cloud security in India,” Malik added. In 2019, integrated risk management solutions will be the second fastest growing segment, with a 23.1 pc year-over-year rise. “Online payments have risen since demonetisation in 2016 and led to an increase in investments toward IT infrastructure security,” Bhajanka said, adding, the move to digital business is also forcing CISOs to increase spending to manage risks arising from cyber-attacks and non-compliance.

|

|

Fintech boom in Chindia

|

|

China and India are leading the global race towards adoption of digital economy or fintech as it is known. Globally, the fintech adoption rates rose to an average 64 pc this year, but China and India topped with 87 pc adoption. There has been exponential rise in India due to government’s digital push including initiatives such as demonetisation, Jan Dhan Yojana, Aadhaar and Unified Payment Interface (UPI), according to an EY study. FinTech adoption in India is driven by greater use of money transfer and payments (94 pc). Within money transfer, adoption is led by peer-to-peer and nonbank money transfers (85 pc), and in-store mobile phone payments (88 pc), says the study, EY Global FinTech Adoption Index 2019. Access to “innovative” products and ease of account opening are key factors driving consumers to FinTech adoption. China and India are leading the global race towards adoption of digital economy or fintech as it is known. Globally, the fintech adoption rates rose to an average 64 pc this year, but China and India topped with 87 pc adoption. There has been exponential rise in India due to government’s digital push including initiatives such as demonetisation, Jan Dhan Yojana, Aadhaar and Unified Payment Interface (UPI), according to an EY study. FinTech adoption in India is driven by greater use of money transfer and payments (94 pc). Within money transfer, adoption is led by peer-to-peer and nonbank money transfers (85 pc), and in-store mobile phone payments (88 pc), says the study, EY Global FinTech Adoption Index 2019. Access to “innovative” products and ease of account opening are key factors driving consumers to FinTech adoption.

“The fintech industry in India is rapidly expanding, and the adoption rate is growing faster than anticipated. One of the reasons for strong growth is that traditional financial services companies have entered the fray in a big way,” Mahesh Makhija, partner and leader, Digital and Emerging Tech at EY said. Globally, nearly 89 pc of consumers are aware of the existence of in-store mobile phone payment platforms and 82 pc are aware of peer-to-peer payment systems and non-bank money transfers. Availability of fintech services is even more accentuated in both India and China with 99.5 pc of consumers aware of money transfer and mobile payment services. The elevated awareness in India stems in part from the government’s plan announced in 2017, to decrease the amount of paper currency in circulation.

Close behind are Russia and South Africa, both with 82 pc adoption. Among the developed markets, the Netherlands (73 pc), the UK (71 pc) and Ireland (71 pc) lead in adoption, reflecting in part the development of open banking in Europe, according to the survey. The index is based on an online survey of more than 27,000 digitally active consumers across 27 markets, including India. This year it also includes a survey of 1,000 small and medium enterprises (SMEs) using fintech services in China, the US, the UK, South Africa and Mexico.

|

|

Fintech newbie BharatPe raises funds

|

|

In a related development, BharatPe, a fintech firm, said it has raised USD 50 million in its latest round of equity financing. This was led by leading global fintech investor, Ribbit Capital and London-based hedge fund, Steadview Capital, BharatPe said in a statement. Existing investors - Sequoia Capital, Beenext Capital and Insight Partners also participated in the round. Within one year of launch, the company has achieved USD 1 billion annualised total payments volume (TPV) and facilitates over 18 million UPI transactions monthly, it said. In a related development, BharatPe, a fintech firm, said it has raised USD 50 million in its latest round of equity financing. This was led by leading global fintech investor, Ribbit Capital and London-based hedge fund, Steadview Capital, BharatPe said in a statement. Existing investors - Sequoia Capital, Beenext Capital and Insight Partners also participated in the round. Within one year of launch, the company has achieved USD 1 billion annualised total payments volume (TPV) and facilitates over 18 million UPI transactions monthly, it said.

|

|

|

Motorola ties up to improve footprint in Tier II Cities

|

|

Motorola is in talks with Udaan, a marketplace that supplies products, to expand its offline footprint in smaller towns and cities. Udaan takes orders online from a retailer, but they service it like any other distributor does, according to Prashanth Mani, managing director, Motorola Mobility India.“We started off our offline expansion last year. We started investing in what is called ‘Moto Mobile Hubs’. We are also looking at a unique way of expanding — we are in talks with Udaan,” Mani told a business daily recently. Motorola currently has over 5,000 offline stores, he added. Mani stated that Motorola does not have too big a presence in smaller towns and Udaan could help them grow in these areas. The company has already tried a pilot project in this regard in Andhra Pradesh. Motorola is in talks with Udaan, a marketplace that supplies products, to expand its offline footprint in smaller towns and cities. Udaan takes orders online from a retailer, but they service it like any other distributor does, according to Prashanth Mani, managing director, Motorola Mobility India.“We started off our offline expansion last year. We started investing in what is called ‘Moto Mobile Hubs’. We are also looking at a unique way of expanding — we are in talks with Udaan,” Mani told a business daily recently. Motorola currently has over 5,000 offline stores, he added. Mani stated that Motorola does not have too big a presence in smaller towns and Udaan could help them grow in these areas. The company has already tried a pilot project in this regard in Andhra Pradesh.

The company has launched the Motorola One Action smartphone, powered by Google’s Android One, priced at INR 14,000 (EUR 180). The smartphone will focus on wide-angle video capture and users will be able to shoot landscape content while holding the phone vertically. On the company’s product strategy, Mani said that the company would largely remain in the INR 6000-20,000 price range, adding that the company will continue with the G series and E series of line-ups but did not comment on the future of the company’s flagship Z series smartphones.

|

|

|

| |

|

|

IT@India, by Biz@India, is the first newsletter about Indian IT for distribution in Europe. For more information, write to newsletter@mediaindia.eu. IT@India and Biz@India are registered TM of Media India Group. If you would like to contribute to the newsletter, please send your contributions to editorial@mediaindia.eu

|

| |

|

|

|