| |

| Bytedance takes the bite |

Chinese technology giant Bytedance, the promoter of social media platforms TikTok and Helo, that have gone viral in India over the last couple of years, has announced that it will establish local data centres in India. The move comes as the company has been under tremendous pressure from the Indian government that has repeatedly tried to muzzle TikTok, an application that allows users to make and post short videos and has been a rage in India, with 120 million active users who regularly make and post videos, including political satire. TikTok had been banned by a court in Tamil Nadu for a brief while, but the ban had been quashed promptly by the nation’s Supreme Court. Chinese technology giant Bytedance, the promoter of social media platforms TikTok and Helo, that have gone viral in India over the last couple of years, has announced that it will establish local data centres in India. The move comes as the company has been under tremendous pressure from the Indian government that has repeatedly tried to muzzle TikTok, an application that allows users to make and post short videos and has been a rage in India, with 120 million active users who regularly make and post videos, including political satire. TikTok had been banned by a court in Tamil Nadu for a brief while, but the ban had been quashed promptly by the nation’s Supreme Court.

However, TikTok’s ease of use and its rapid rise in India has had the government worried about the use of the app for raking up controversial issues as well as anti-government messages. Bytedance has been issued another notice by the Indian government that alleged a misuse of TikTok and Helo for alleged ‘anti-national activities’. The government has warned that it might be banned unless it submitted appropriate responses to the questions by July 22. “We are now in the process of examining options for safe, secure and reliable services for our Indian users within India's borders,’’ Bytedance announced via a press release.

The move would be in line with the Indian government’s efforts towards data localisation for user data gathered from India by various companies. According to Business Standard, the investment towards local data centres will be part of the billion dollar investment in India that Bytedance had announced earlier this year. The company ‘has an internal target of 6-18 months’ to set up the data centres, the report said. The company also said that it has so far been storing Indian users’ data in third party servers located in the United States (US) and Singapore. The company had claimed the same earlier this month as well, when Congress MP Shashi Tharoor accused the company of collecting user data illegally and sending it to China.

“These claims are simply untrue. The privacy and security of our users is a top priority for TikTok, and we abide by local laws and regulations in the markets where we operate,’’ the company had responded in a statement then.

|

Sharp fall in Indian server market |

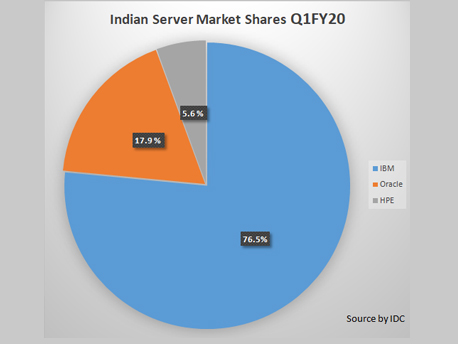

The server market in India has declined by a sixth in annualised value terms to reach USD 298 million in the first quarter of 2019 as against USD 355.8 million in same quarter last year, according to data firm, the International Data Corporation (IDC). The x86 server market now accounts for 88.9 pc of the overall server market in terms of revenue, IDC says. IBM tops the market with a revenue share of 76.5 pc, followed by Oracle with share of 17.9 pc and HPE with 5.6 pc, said IDC. The server market in India has declined by a sixth in annualised value terms to reach USD 298 million in the first quarter of 2019 as against USD 355.8 million in same quarter last year, according to data firm, the International Data Corporation (IDC). The x86 server market now accounts for 88.9 pc of the overall server market in terms of revenue, IDC says. IBM tops the market with a revenue share of 76.5 pc, followed by Oracle with share of 17.9 pc and HPE with 5.6 pc, said IDC.

‘‘In the current scenario, enterprises of all sizes are investing in their data centres to make it more agile, scalable, flexible there by making business applications highly available,’’ Harshal Udatewar, market analyst, Server, IDC India, said in a statement. The contribution to the x86 server market mostly came from the professional services vertical followed by manufacturing, banking, government and telcos.

Banking remained top vertical with 45.8 pc revenue share followed by manufacturing and utilities with 22.0 pc and 10.3 pc respectively, during Q1.

|

Infosys completes US localisation target |

Faced with continued uncertainty over the fate of H1B visas for the Indian tech workers in the United States as well as an unpredictable Trump administration, India’s second largest tech firm Infosys says that it has already hired over 10,000 local employees in the United States by the end of the last quarter and hence completed its localisation target for the country. The tech major is planning to raise the number of locals in the coming quarters in a market that accounts for over 60 pc of the company’s total revenues. Faced with continued uncertainty over the fate of H1B visas for the Indian tech workers in the United States as well as an unpredictable Trump administration, India’s second largest tech firm Infosys says that it has already hired over 10,000 local employees in the United States by the end of the last quarter and hence completed its localisation target for the country. The tech major is planning to raise the number of locals in the coming quarters in a market that accounts for over 60 pc of the company’s total revenues.

Infy is not alone in adopting these measures. With increasing restriction on employee movement owing to H1B visa restriction, all Indian tech firms have been adding local employees in the US. After the announcement of quarterly results, chief operating officer of Infosys U B Pravin Rao said there were no new numbers for local hiring in the US to announce at this point. In May 2017, the company had announced plans to set up four technology and innovation hubs in the US and also hire about 10,000 locals over a two-year period as part of its localisation drive. Infosys says it has set up four technology and innovation hubs in Indianapolis (Indiana), Raleigh (North Carolina), Hartford (Connecticut), and Phoenix (Arizona).

Meanwhile, apart from hiring engineering students, the IT firm is also taking students with non-STEM (science, technology, engineering and mathematics) background in the US. Fresh graduates with design or other creative skills are being recruited by the IT services firm, Rao said. ‘‘In terms of subcontracting, I think, both (subcontractor and own employees) will exist. There's always some demand which comes in where the fulfilment needs to be done on a relatively quick basis,’’ said Salil Parekh, CEO & MD at Infosys. ‘‘We have some operational levers that we're putting in place, including localisation which will help us adjust the subcontracting usage,’’ he added.

But hirings in the US are pinching the Indian tech giant and its operating margins that were 20.5 pc in the first quarter of the current fiscal, had been hit by 140 bp due to higher wage bills. Recently, the company had announced a 6 pc wage hike for its employees located in India. For overseas employees, it was pegged at 1.5 pc.

|

Mindtree plunges on the bourses |

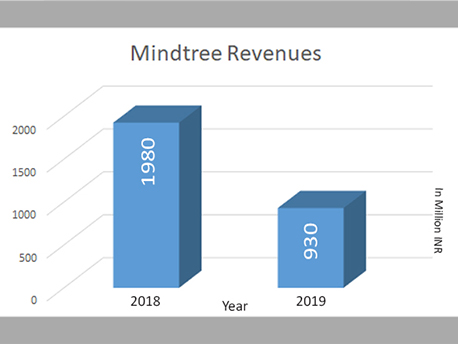

Mid sized tech firm Mindtree, that had been in the headlines due to a futile bid by its promoters to fight a hostile takeover bid by Larsen &Toubro, saw its share stake a plunge on the Indian bourses last week. The shares of the company fell by 10 pc to INR 675, a new 52-week low, after the company’s consolidated net profit more than halved to INR 930 million (USD 15 million) in June quarter (Q1FY20), as compared to previous quarter. It had reported a profit of INR 1980 million (USD 32 million) in the previous quarter. The IT consulting & software company's operational revenues declined marginally. “This included a one-time special award to employees to mark Mindtree’s 20th anniversary – excluding which, its margin declined by 392bps (significantly 209bps below our estimate) on regular wage hike impact, INR appreciation, higher visa cost and higher depreciation owing to adoption of Ind AS 116,” analysts at Reliance Securities said in result update. Mid sized tech firm Mindtree, that had been in the headlines due to a futile bid by its promoters to fight a hostile takeover bid by Larsen &Toubro, saw its share stake a plunge on the Indian bourses last week. The shares of the company fell by 10 pc to INR 675, a new 52-week low, after the company’s consolidated net profit more than halved to INR 930 million (USD 15 million) in June quarter (Q1FY20), as compared to previous quarter. It had reported a profit of INR 1980 million (USD 32 million) in the previous quarter. The IT consulting & software company's operational revenues declined marginally. “This included a one-time special award to employees to mark Mindtree’s 20th anniversary – excluding which, its margin declined by 392bps (significantly 209bps below our estimate) on regular wage hike impact, INR appreciation, higher visa cost and higher depreciation owing to adoption of Ind AS 116,” analysts at Reliance Securities said in result update.

With new promoter Larsen &Toubro (L&T) taking charge, Mindtree’s senior management team has resigned. Despite healthy deal wins during the quarter, steeper-than-expected margin contraction indicates a lackadaisical beginning of the fiscal.

Even factoring in improved performance from Q2 FY20E onwards, we believe Mindtree is unlikely to achieve over 11-12 pc USD revenue growth, which is a come down from the ‘low teens growth’ the IT firm had alluded to at the end of Q4FY19. Until we see further clarity on these developments, and stability in terms of personnel and attrition, the stock is likely to trend flat-to-downwards, in our view, the brokerage firm said. Meanwhile, Mindtree has appointed L&T chief AM Naik as non-executive chairman.

|

Cyient takes a hit too |

Cyient Limited, a Hyderabad-based technology firm focused on engineering, manufacturing and data analytics, saw its share stake a hammering in the Indian stock markets as the scrip lost 11 pc on Friday to hit its 52-week low. The fall has been blamed on disappointing numbers reported by the company for the first quarter of this fiscal year. Cyient recorded a revenue of USD 157 million, a fall of 5.2 pc quarter on quarter and 3 pc year on year and a good 5 pc below analyst estimates. This is the company’s worst performance in the past 10 years. Cyient Limited, a Hyderabad-based technology firm focused on engineering, manufacturing and data analytics, saw its share stake a hammering in the Indian stock markets as the scrip lost 11 pc on Friday to hit its 52-week low. The fall has been blamed on disappointing numbers reported by the company for the first quarter of this fiscal year. Cyient recorded a revenue of USD 157 million, a fall of 5.2 pc quarter on quarter and 3 pc year on year and a good 5 pc below analyst estimates. This is the company’s worst performance in the past 10 years.

“Cyient has had a very slow start to the year led by multiple challenges. Q1FY20 has been the third consecutive quarter of disappointment. We expect Cyient's services business revenues to grow in low single digit in FY20. Revenue growth would be lower than most of its peers in FY20 and FY20 would be second consecutive year of single digit growth in services business. Led by Q1 miss on both revenues and margins we trimour EPS numbers by around 9/8 pc in each of FY20/FY21,” analysts at Antique Stock Broking said in a result review.

“Margin was impacted by revenue decline and wage hike (85bps). Margin will recover with growth and cost optimisation measures but double digit EBIT growth for FY20E appears an uphill task,” analysts at HDFC Securities wrote in an earnings review note. The brokerage has maintain edits ‘neutral’ stance on the stock on hopes of recovery in, both, revenue and margin but flagged concerns related to slowdown in decision making, accelerated trade war risks and higher mix of legacy services.

|

|

| |

|

| IT@India, by Biz@India, is the first newsletter about Indian IT for distribution in Europe. For more information, write to newsletter@mediaindia.eu. IT@India and Biz@India are registered TM of Media India Group. If you would like to contribute to the newsletter, please send your contributions to editorial@mediaindia.eu |

| |

|

|

|