| |

| Automation Anywhere buys Paris-based Klevops |

Automation Anywhere, a robotic process automation (RPA) company, has announced that it has acquired Klevops, a privately-held company based in Paris. With the acquisition, Automation Anywhere fast forwards the RPA category to Attended Automation 2.0, where managers can easily orchestrate work streams across a team of employees and bots, driving a higher level of employee productivity and improved customer experience. Automation Anywhere, a robotic process automation (RPA) company, has announced that it has acquired Klevops, a privately-held company based in Paris. With the acquisition, Automation Anywhere fast forwards the RPA category to Attended Automation 2.0, where managers can easily orchestrate work streams across a team of employees and bots, driving a higher level of employee productivity and improved customer experience.

This enables customers to automate more processes than ever before, with the same level of central governance, security and analytic capability for which Automation Anywhere has always been known. “We are taking a bold step forward in delivering Attended Automation 2.0, a next-generation RPA solution that changes the way people work,” said Prince Kohli, chief technology officer, Automation Anywhere. “The acquired technology from Klevops will alter the dynamics between attended and unattended automation, making it a foundational solution for companies scaling their automation initiatives across industries. This is especially relevant to contact centre-intensive industries such as banking, financial services and telecommunications,” he added.

|

Govt may finalise BSNL rescue package shortly |

The government is expected to finalise a plan to revive ailing state-owned telecom carriers — Bharat Sanchar Nigam Ltd (BSNL) and Mahanagar Telephone Nigam Ltd (MTNL) — by end of this month. Separately, the country’s telecom licensor has also provided INR 5 billion to BSNL, which will be used to foot the PSU’s July employee wages. “Since the revised Cabinet memo was prepared incorporating the suggestions of the Group of Ministers (GoM), a separate approval from the GoM is not necessary. The government is expected to finalise a plan to revive ailing state-owned telecom carriers — Bharat Sanchar Nigam Ltd (BSNL) and Mahanagar Telephone Nigam Ltd (MTNL) — by end of this month. Separately, the country’s telecom licensor has also provided INR 5 billion to BSNL, which will be used to foot the PSU’s July employee wages. “Since the revised Cabinet memo was prepared incorporating the suggestions of the Group of Ministers (GoM), a separate approval from the GoM is not necessary.

DoT is expecting to receive Cabinet approval by August 31,” a source close to the development told a financial daily. The government is working on a “war-footing” to get the approvals, while the implementation of the recommendations are expected to take more time. As part of the revised revival plan, which was approved by telecom minister Ravi Shankar Prasad last week, a merger of the two loss-making PSUs — BSNL and MTNL — is on the anvil. MTNL, a listed entity, will be converted into a subsidiary of BSNL following the merger. The merger would be conducted after sorting out issues such as human resources. A joint committee will be put in place to oversee the entire process over the next 18 months, according to a memo approved by the minister.

The approved plan has been circulated to other ministries for comments, while the final approval has to be given by the Cabinet. The revival plan includes a capital infusion of INR 142 billion into BSNL to acquire 4G spectrum, land monetisation to meet its expansion plans, setting up a special-purpose vehicle to which INR 230 billion of BSNL’s debt and an equivalent land parcel would be transferred, and financial support for BSNL’s rural exchanges. A Voluntary Retirement Scheme (VRS) for employees above 50 years and reduction of the retirement age to 58 also figure in the plan.

|

Immediate digital payments pick up pace |

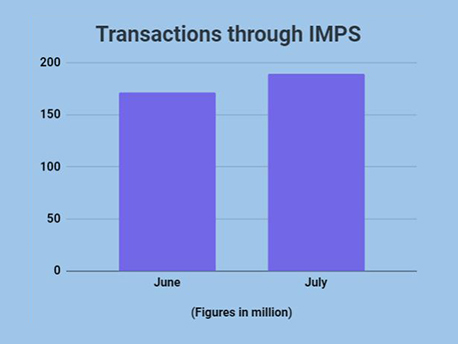

Immediate Payment Service, or IMPS, is gaining traction, with the number of transactions rising to 190 million in July even as the transaction value for UPI and the Centre’s flagship digital payment app BHIM continued to decline for the second straight month. Immediate Payment Service, or IMPS, is gaining traction, with the number of transactions rising to 190 million in July even as the transaction value for UPI and the Centre’s flagship digital payment app BHIM continued to decline for the second straight month.

According to data released by the National Payments Corporation of India, IMPS, with 498 member-banks, hit a record high in July in terms of value, too. As many as 189.2 million transactions amounting to over INR 1820 trillion were conducted through IMPS in July against 171.3 million transactions worth over INR 1730 trillion in June. With the State Bank of India, the largest bank in the country, removing charges on IMPS from August 1 for certain customers and transactions, it is expected that other banks will also follow suit, further increasing the usage of IMPS. The service provides real-time instant fund transfer 24X7.

Meanwhile, in the case of UPI and BHIM, while the total number of transactions on the two platforms continued to rise at a steady pace, the value of transactions dipped. The number of UPI transactions in July touched 822 million as against 754 million in June, but the value of transactions declined slightly to INR 1460 trillion from the June level. Similarly, the amount or value of transactions conducted through BHIM stood at INR 61.21 billion last month compared to INR 62.03 billion in June. There are 143 banks that are live on the UPI and 114 on the BHIM app.

The NPCI data come at a time when the currency in circulation is at an all-time high of over INR 210 trillion and even as a large number of rival apps are gaining in popularity for digital payments. ‘‘Banks offer IMPS across all channels including internet and mobile banking and through business correspondents to customers making it easy to access. Also, it is very popular for remittances and corporate payments to customers,’’ said Praveena Rai, COO, NPCI.

|

A Maveric rise in revenues |

Chennai-based banking technology solutions provider Maveric Systems is aiming to double its revenues to INR 6500 million over the next four years, due to a rising IT spend by global banks. “Our quality assurance and engineering services had a base revenue of over INR 2900 million in FY19 and is expected to post a 20 pc growth trajectory for the next three years,” said Ranga Reddy, chief executive officer at Maveric Systems. “Data transformation, digital technologies, T24 (core banking solution) and telecom, which constitute 20 pc of the overall FY20 revenues, are poised to grow over 40 pc in the next three years,’’ he added. Chennai-based banking technology solutions provider Maveric Systems is aiming to double its revenues to INR 6500 million over the next four years, due to a rising IT spend by global banks. “Our quality assurance and engineering services had a base revenue of over INR 2900 million in FY19 and is expected to post a 20 pc growth trajectory for the next three years,” said Ranga Reddy, chief executive officer at Maveric Systems. “Data transformation, digital technologies, T24 (core banking solution) and telecom, which constitute 20 pc of the overall FY20 revenues, are poised to grow over 40 pc in the next three years,’’ he added.

The company says it enables banks to achieve faster time-to-market, agility through bi-modal approaches, open banking adoption and integration of legacy back-end with digital front-end. Four top banks in the US — Bank of America, Citigroup, JPMorgan Chase and Wells Fargo — spent a cumulative USD40 billion on the information technology space in FY19 and it is expected to exceed USD65 billion this year, while in the Middle East and North Africa, the banking and securities IT spending is expected to reach USD13.2 billion in 2019, the highest in spending among all industries, according to Gartner.

|

UrbanClap gets additional funding |

Tiger Global has led a Series E funding round totalling USD75 million in the managed marketplace for home services, UrbanClap. Existing investors, Steadview Capital and Vy Capital, also participated in the round. This transaction was split into two parts – a primary round, which resulted in a share subscription by the above named investors, and a secondary share sale by some early institutional investors. The Gurugram-based start-up has raised a total of USD185.9 million to date. Tiger Global has led a Series E funding round totalling USD75 million in the managed marketplace for home services, UrbanClap. Existing investors, Steadview Capital and Vy Capital, also participated in the round. This transaction was split into two parts – a primary round, which resulted in a share subscription by the above named investors, and a secondary share sale by some early institutional investors. The Gurugram-based start-up has raised a total of USD185.9 million to date.

Former Flipkart executive Mekin Maheshwari, Flipkart CEO Kalyan Krishnamurthy and Ratan Tata have also invested in the start-up. Founded in November 2014 by Abhiraj Singh Bhal, Raghav Chandra and Varun Khaitan, UrbanClap operates in India and the UAE. Consumers can order services such as beauty and spa at home, deep cleaning services, appliance repairs, plumbing, carpentry, home painting and more through its mobile app and website. Within India its services are available in Ahmedabad, Bengaluru, Chandigarh, Chennai, Delhi NCR, Hyderabad, Jaipur, Kolkata, Mumbai and Pune. Its services are also available in two international markets - Dubai and Abu Dhabi.

|

|

| |

|

| IT@India, by Biz@India, is the first newsletter about Indian IT for distribution in Europe. For more information, write to newsletter@mediaindia.eu. IT@India and Biz@India are registered TM of Media India Group. If you would like to contribute to the newsletter, please send your contributions to editorial@mediaindia.eu |

| |

|

|

|